tsg-upravdom.ru

Prices

Dscr Example

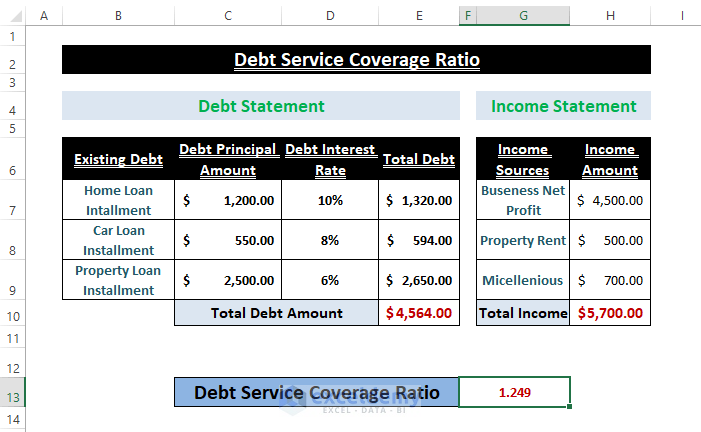

How Can I Increase My DSCR Ratio? DSCR Example. What Is DSCR Ratio Formula? The formula for calculating DSCR (Debt Service Coverage Ratio) is as follows. The DSCR loan approval process works similarly to other real estate loans. For example, you'll be required to pay closing costs, including origination. Here's an example of how the DSCR works:A yacht manufacturing company is seeking a loan to expand its business and wants to find its DSCR before approaching. The annual debt service in this example is less than the Net Operating Income, which makes the monthly cash flow positive. Learn More. What is a DSCR Loan? Example of How to Calculate Debt Service Coverage Ratio. We would plug the numbers into our DSCR formula and calculate as follows: DSCR - Sample Calculation. Lenders often require a DSCR of to for commercial real estate loans. Examples of DSCR Calculation: Example 1: A company has a net operating income of. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. The debt service coverage ratio (DSCR), also known as "debt coverage For example, if a property has a debt coverage ratio of less than one, the. The DSCR is a cash coverage ratio. It measures how many times you can payyour mortgage payment including principal,interest, taxes, and insurance (HOA if. How Can I Increase My DSCR Ratio? DSCR Example. What Is DSCR Ratio Formula? The formula for calculating DSCR (Debt Service Coverage Ratio) is as follows. The DSCR loan approval process works similarly to other real estate loans. For example, you'll be required to pay closing costs, including origination. Here's an example of how the DSCR works:A yacht manufacturing company is seeking a loan to expand its business and wants to find its DSCR before approaching. The annual debt service in this example is less than the Net Operating Income, which makes the monthly cash flow positive. Learn More. What is a DSCR Loan? Example of How to Calculate Debt Service Coverage Ratio. We would plug the numbers into our DSCR formula and calculate as follows: DSCR - Sample Calculation. Lenders often require a DSCR of to for commercial real estate loans. Examples of DSCR Calculation: Example 1: A company has a net operating income of. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. The debt service coverage ratio (DSCR), also known as "debt coverage For example, if a property has a debt coverage ratio of less than one, the. The DSCR is a cash coverage ratio. It measures how many times you can payyour mortgage payment including principal,interest, taxes, and insurance (HOA if.

For example, imagine a company that took out a loan from a startup financing firm to get the ball rolling on its operations. The DSCR breaks down how much of. DSCR Example. DecoHome is a firm comprised by interior designers, architects and civil engineers who offer design and remodeling services to homeowners who. Debt-service coverage ratio examples. Now that we've covered a basic calculation method for DSCR, let's plug that into an example so you can see it in action. For example: let's say that you buy a rental property in Atlanta, GA, expecting to be able to charge $1,/month for rent, with the PITIA on the property. DSCR formula. Debt Service Coverage Ratio = Net Operating Income / Debt Service. For example, if a rental property is generating an annual NOI of $6, and. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. How to calculate DSCR using its standard formula, including examples for better comprehension. The significance of DSCR in securing loans, managing debt, and. As an example, let's say Company A has net operating income of $2,, for one year and total debt servicing costs equal to $, for that year. Company. An Example Of The DSCR Formula In Real Estate. Say you want to buy a $, home. If you make a down payment of $25,, you're left with a. DSCR Example. Let's say you own a rental property that generates $30, in NOI and the monthly mortgage payments (principal and interest) are $2, or $24, DSCR Loan Sizing Analysis Example If the commercial loan is sized at $ million, the debt service coverage ratio (DSCR) is x, which is an optimal DSCR. The DSCR ratio typically uses EBITDA or Net Operating Income to represent cash flow and divides that figure by the sum of loan interest and principal debt. DSCR Formula for Real Estate. DSCR = Annual Income – Annual Expenses (NOI) / Total Debt Obligations. DSCR Real Estate Example. To complete this DSCR Example. Let's take a look at an example where the CFADS are flat and the debt is repaid on annuity basis, which means equal P+I. Period-by-period DSCRs are then. Debt Service Coverage Ratio (DSCR) · DSCR Overview · The need for the ratio · Typically the DSCR is used: · Ratio variations · Worked example · What does it affect? Keep in mind that different industries have different DSCR standards. For example, service industries like restaurants and breweries often have higher DSCRs. As an example, a coverage ratio means that the rental payments aren't enough to cover the mortgage, and the missing 15% has to be covered by the borrower. In this example, XYZ Company has a debt-service coverage ratio of , meaning it has 7% more income than is needed to cover current debts. A commercial. Guide to the the debt service coverage ratio (DSCR) in real estate, including definition, formula, how to calculate, example calculations, tips & more. (example: A ratio of means that the rent supports % of the new payment). A DSCR loan is similar to that of a commercial loan program that uses debt.

Who Should Buy Renters Insurance

Renters insurance also provides personal liability protection in case someone is injured in your home. This guide offers everything you need to know about. If your apartment is broken into and you have belongings stolen, renters' insurance can help you replace them. It can also protect you from lawsuits if someone. State Farm is our No. 1 pick for the best renters insurance company given their affordable rates and optional inflation coverage. When buying renters insurance. To financially protect yourself you will need to buy renters or tenants insurance. Renters insurance protections. Like homeowners insurance, renters. 6 Good Reasons to Get Renter's Insurance · 1. It's Relatively Affordable · 2. It Covers Losses to Personal Property · 3. Your Landlord Might Require It · 4. It. Allstate renters insurance, also known as tenant insurance, is reliable, affordable and can cost less than you think. To protect yourself and your belongings, renters should consider purchasing renters insurance, also known as "tenants insurance." What is Renter's Insurance? A standard renters insurance policy protects your electronics and appliances against certain “perils,” but not against every type of damage. For instance, if. Renters insurance protects your belongings from loss, damage, or destruction following things like burglaries, fires, tornadoes and other covered events. Renters insurance also provides personal liability protection in case someone is injured in your home. This guide offers everything you need to know about. If your apartment is broken into and you have belongings stolen, renters' insurance can help you replace them. It can also protect you from lawsuits if someone. State Farm is our No. 1 pick for the best renters insurance company given their affordable rates and optional inflation coverage. When buying renters insurance. To financially protect yourself you will need to buy renters or tenants insurance. Renters insurance protections. Like homeowners insurance, renters. 6 Good Reasons to Get Renter's Insurance · 1. It's Relatively Affordable · 2. It Covers Losses to Personal Property · 3. Your Landlord Might Require It · 4. It. Allstate renters insurance, also known as tenant insurance, is reliable, affordable and can cost less than you think. To protect yourself and your belongings, renters should consider purchasing renters insurance, also known as "tenants insurance." What is Renter's Insurance? A standard renters insurance policy protects your electronics and appliances against certain “perils,” but not against every type of damage. For instance, if. Renters insurance protects your belongings from loss, damage, or destruction following things like burglaries, fires, tornadoes and other covered events.

A renters policy is good for covering the tenants stuff and liability if they do something wrong. You should definitely have the tenant get a. Some of the primary reasons why you should require your tenants to have renters' insurance is as follows: Relocation Costs. Renters insurance will help pay for. Keep in mind, renters insurance isn't the same as home or landlord insurance. Those are designed for property owners and don't give you the protection you need. Consider buying renters insurance if you are renting. TOP CONSIDERATIONS insurance company if you will need to buy additional coverage. 3. While. 1. It's Relatively Affordable · 2. It Covers Losses to Personal Property · 3. Your Landlord Might Require It · 4. It Provides Liability Coverage · 5. It Covers Your. To protect yourself and your belongings, renters should consider purchasing renters insurance, also known as "tenants insurance." What is Renter's Insurance? Some apartments are now partnering with insurance companies to offer renters insurance to new tenants and stipulating that they must have some sort of. A:Answer Simply put, renters need insurance to protect their stuff. As a renter, you don't own the structure you live in and you are not likely to insure it. Unlike a homeowner who is required by their mortgage company to buy insurance, there is generally no requirement to purchase renters insurance. Renters insurance protects your personal property against damage or loss, and insures you in case someone is injured while on your property. Though renters insurance isn't required by law, the III points out that landlords can require tenants to carry renters insurance. In other words, if your lease. Typically, the law does not require tenants to purchase renters insurance. Nonetheless, given its benefits to both landlords and tenants, your landlord has the. Complete an inventory of your possessions. Personal property coverage is probably the main reason most purchase a renters policy. · Check with your insurance. If you are a renting an apartment, condo or house, you should consider buying renters insurance. With premiums averaging $ per month for $20, to. If you rent an apartment or home to live in, you might want to consider renter insurance to cover your belongings and liabilities. Speaking as a landlord I require that my tenants purchase liability insurance with a minimum of $ coverage. This is to protect me in. If your friend slips and falls while you're hosting a party at your apartment, you could be liable. Fortunately, if someone is injured on your property, or if. While there is no absolute number that you need to aim for in terms of renters insurance, you should require renters to obtain a policy that covers their. If you rent an apartment or a home, consider buying renters insurance. Renters insurance covers your personal belongings and provides liability coverage. Some insurers allow roommates to be insured under a single policy. In these instances, roommates must agree to the level of coverage, based on the combined.

National Stock Exchange Of India

/National_Stock_exchange_Mumbai-7f589a0d7ae248408ad1c8f9ffd97584.jpg)

The National Stock Exchange (NSE) is the leading stock exchange in India and the fourth largest in the world by equity trading volume in About NSE · nse logo NSE International Exchange Limited is a fully owned subsidiary company of National Stock Exchange of India Limited (NSE). The National Stock Exchange of India Limited is the country's leading financial exchange, with headquarters in Mumbai. It was incorporated in and. BSE (formerly Bombay Stock Exchange) - LIVE stock/share market updates from Asia's premier stock exchange. Get all the live BSE SENSEX. National Stock Exchange of India Limited (NSE) is one of the leading stock exchanges in India, based in Mumbai. NSE is under the ownership of various. K Followers, 0 Following, Posts - NSE India (@nseindia) on Instagram: "Official handle of India's largest stock exchange & world's largest. National Stock Exchange (NSE) was incorporated in and commenced operations in It is the leading exchange in India and is ranked 12th in the world. Recognizing the important role that stock exchanges play in enhancing corporate governance (CG) standards, NSE has organized new initiatives relating to CG. The National Stock Exchange of India (NSE) is India's largest financial market. Incorporated in and launched in , the NSE has developed into a. The National Stock Exchange (NSE) is the leading stock exchange in India and the fourth largest in the world by equity trading volume in About NSE · nse logo NSE International Exchange Limited is a fully owned subsidiary company of National Stock Exchange of India Limited (NSE). The National Stock Exchange of India Limited is the country's leading financial exchange, with headquarters in Mumbai. It was incorporated in and. BSE (formerly Bombay Stock Exchange) - LIVE stock/share market updates from Asia's premier stock exchange. Get all the live BSE SENSEX. National Stock Exchange of India Limited (NSE) is one of the leading stock exchanges in India, based in Mumbai. NSE is under the ownership of various. K Followers, 0 Following, Posts - NSE India (@nseindia) on Instagram: "Official handle of India's largest stock exchange & world's largest. National Stock Exchange (NSE) was incorporated in and commenced operations in It is the leading exchange in India and is ranked 12th in the world. Recognizing the important role that stock exchanges play in enhancing corporate governance (CG) standards, NSE has organized new initiatives relating to CG. The National Stock Exchange of India (NSE) is India's largest financial market. Incorporated in and launched in , the NSE has developed into a.

The Securities and Exchange Board of India (SEBI) is the regulatory authority established under the SEBI Act and is the principal regulator for Stock. Department of Investment and Public Asset Management, Ministry of Finance, Government of India. Toggle navigation Home About DIPAM Vision, Mission and Mandate. The National Stock Exchange of India Limited (NSE) commenced trading in derivatives with the launch of index futures on 12 June The futures and options. NSE India (National Stock Exchange of India Ltd) – LIVE Share/Stock Market Updates Today. Get all latest share market news, live charts, analysis, ipo. The National Stock Exchange (NSE) is the leading stock exchange in India and the fourth largest in the world by equity trading volume in Trading Hours Summary: The India National Stock Exchange is open Monday through Friday from am to pm India Standard Time (GMT+). The National Stock Exchange (NSE) is an Indian stock market situated in Mumbai and founded in It is the second-biggest securities exchange company in. Indices ; Nifty MNC. 30,, % ; Nifty Growth Sectors 12,, % ; Nifty Services Sector. 31,, % ; NIFTY Quality 6,, %. What is NSE? Established in , the National Stock Exchange of India Limited (NSE) is the first dematerialised electronic exchange institution in the Indian. Legal Name National Stock Exchange of India Ltd. facilities that serve as a model for the securities industry in terms of systems, practices, and procedures. Indices ; Nifty MNC. 30,, % ; Nifty Growth Sectors 12,, % ; Nifty Services Sector. 31,, % ; NIFTY Quality 6,, %. India has two primary stock markets, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE is India's oldest stock exchange. Stay up-to-date with breaking news and top stories on National Stock Exchange of India Ltd. In-depth analysis, industry insights and expert opinion. NSE Indices · Exchanges · National Stock Exchange of India. Trading symbol, ^NSEI. Constituents, Type, Large cap. Weighting method, Free-float. The National Stock Exchange is one of the two premier exchanges in India. The NSE was the first ever exchange in the country to have introduced a fully. The NSE implemented IBM Resiliency Orchestration and achieved an 80% leap in RTO, from 4 hours to less than 40 minutes. NSE India, Mumbai, Maharashtra. likes · talking about this · were here. Official page of NSE - India's largest stock exchange &. National Stock Exchange of India Ltd: Overview National Stock Exchange of India Ltd (NSE) is a market infrastructure institution that operates a comprehensive. The National Stock Exchange of India Limited (NSE) is the largest financial exchange in the Indian market. It was established in NSE India, Mumbai, Maharashtra. likes · talking about this · were here. Official page of NSE - India's largest stock exchange &.

Cost For Gutters On A House

Typically, the cost of new gutters in Houston will range between $1, to $6, The average cost of a new gutter system is roughly $3, Your gutter system. The cost of your gutter installation depends on what type of gutters you choose for your home, size, and a few other factors. With that in mind your gutter. Normal k-style gutters should run at most $12 a foot. Guards usually a foot. The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This is mainly dependent on a number of factors. Learn more here! Seamless gutters costs range from $ and $1,, with an average cost of $1, The cost for this type of gutter depends on a number of factors, including. The average cost will be approximately $15 per linear foot, depending on the size of your home, the type of gutter system you choose, and any additional. K-style gutters cost $3 to $37 per linear foot, depending on materials, and are the most common type for homes built in the last 50 years. They feature a flat. On the high end, we've seen gutter prices soar over $11,, which could be the case if your project requires more gutters than the average home — for example. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options. Typically, the cost of new gutters in Houston will range between $1, to $6, The average cost of a new gutter system is roughly $3, Your gutter system. The cost of your gutter installation depends on what type of gutters you choose for your home, size, and a few other factors. With that in mind your gutter. Normal k-style gutters should run at most $12 a foot. Guards usually a foot. The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This is mainly dependent on a number of factors. Learn more here! Seamless gutters costs range from $ and $1,, with an average cost of $1, The cost for this type of gutter depends on a number of factors, including. The average cost will be approximately $15 per linear foot, depending on the size of your home, the type of gutter system you choose, and any additional. K-style gutters cost $3 to $37 per linear foot, depending on materials, and are the most common type for homes built in the last 50 years. They feature a flat. On the high end, we've seen gutter prices soar over $11,, which could be the case if your project requires more gutters than the average home — for example. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options.

Usually, the price of seamless gutters in the Chicago-land area is between $9-$15 per linear foot. Learn more about the factors that affect the cost of gutters. Usually, the price of seamless gutters in the Chicago-land area is between $9-$15 per linear foot. Learn more about the factors that affect the cost of gutters. The cost for these seamless gutter systems ranges from $ to $ per linear foot due to the increased material costs. Average Cost Of Box-Style Seamless. Typically, the total cost of installing this system is around $ per square foot for professional installation. Every 35 feet of gutter requires a downspout. Typically, homeowners can anticipate paying between $75 and $ for professional gutter cleaning services. The cost is influenced by factors. The cost of gutter installation can vary based on different factors. These factors include the material, style, size, quality, downspouts, end caps, installed. Gutter installation costs between $5, and $14, for to feet of materials plus labor. It's a major investment, but the right gutters can protect. In our experience, a realistic range for combined total install cost is $ to $ per foot. Note that the dimensions of a particular house will affect. Most homeowners in Tampa pay an average of around $2, to have a full gutter system installed. There is some variation in pricing, but you can expect a total. Generally speaking the average cost of having gutters custom manufactured and installed on your Florida home is approximately $4 per linear foot. Q: How long do. It is difficult to select a fixed rate for gutter replacement. Rather, averages must be considered. Expect to pay between $2, and $6, on an average-sized. For businesses looking to install new gutters, the cost typically ranges from $10 to $25 per square foot. This variation depends on several. Because of all this variability, national average prices for gutter installation range from $2, to $4,, and some homeowners pay significantly more. Gutter Cost. Many homeowners want to know how much gutters cost before signing up for an estimate. We hear it all the time, “how much do gutters cost?”, “how. with drop. View Results. All Filters. Gutter Size open arrow. Color Family open arrow. Material open arrow. Brand open arrow. Price open arrow. Gutter Size. On average, you can expect to pay around $ a linear foot for new gutters in Houston. In addition, a full gutter replacement in Houston will usually cost. The average price for materials and installation is $–1,, or $11–28 per linear foot. How much does it cost to put gutters on a 1,sq-ft house? To. A comprehensive gutter system costs about $ for Montgomery homeowners. Prices range from $ to $ Are you Interested? Click Here To Learn More!!! No two homes are exactly the same, and therefore, no two gutter situations are either. Because of this, when we talk about the cost of gutters. In general, however, your standard 5″ K style gutter will cost anywhere from approximately $$10 per foot (one story) while 6″ K style gutter will run.

Leasing Then Buying The Car

:max_bytes(150000):strip_icc()/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-6ccebddf50af4f7ba914398272f2ad46.jpg)

Monthly loan payments are usually higher than monthly lease payments because you are paying for the entire purchase price of the vehicle, plus interest and. When Should You Buy Out Your Leased Vehicle? Many car lease contracts give you the option to buy your vehicle at the end of the contract rather than simply. Leasing and then buying a car can be a profitable option if you get a great deal on the lease and payoff amount. However, if you're not able to negotiate a good. Generally speaking, a new car lease saves money in the short term with lower monthly payments, while buying gets you a long term investment. Leasing a car tends to be more affordable than buying a car because you have lower monthly payments, as well as a lower down payment. Leasing typically has a significantly smaller monthly payment than financing a car purchase because you're essentially renting the car instead of buying it. Deciding whether to buy your leased car is fraught with challenges. Learn how to assess the benefits and pitfalls and how they can help you choose. Guaranteed Future Value - You don't have to worry about resale value. If your car depreciates more than the estimated residual value in your lease contract at. Buying a leased car for less than its current market value could be a good financial move. 5. You may be able to transfer your lease to a new driver. If you. Monthly loan payments are usually higher than monthly lease payments because you are paying for the entire purchase price of the vehicle, plus interest and. When Should You Buy Out Your Leased Vehicle? Many car lease contracts give you the option to buy your vehicle at the end of the contract rather than simply. Leasing and then buying a car can be a profitable option if you get a great deal on the lease and payoff amount. However, if you're not able to negotiate a good. Generally speaking, a new car lease saves money in the short term with lower monthly payments, while buying gets you a long term investment. Leasing a car tends to be more affordable than buying a car because you have lower monthly payments, as well as a lower down payment. Leasing typically has a significantly smaller monthly payment than financing a car purchase because you're essentially renting the car instead of buying it. Deciding whether to buy your leased car is fraught with challenges. Learn how to assess the benefits and pitfalls and how they can help you choose. Guaranteed Future Value - You don't have to worry about resale value. If your car depreciates more than the estimated residual value in your lease contract at. Buying a leased car for less than its current market value could be a good financial move. 5. You may be able to transfer your lease to a new driver. If you.

Leasing a car is much cheaper than buying it outright, because you're only paying a percentage of the total price. The initial payment on a lease can be less than the down payment required to buy the same vehicle. When you lease a car, you are really paying rent for its use. When you lease a car, your monthly rentals are usually lower than when you finance the car. You're not paying to purchase the vehicle, so your monthly outgoings. "The long-term cost of leasing is ALWAYS MORE than the cost of buying, assuming the buyer keeps his vehicle after loan-end." If a buyer keeps his car after the. If you have a 3 yr lease ending soon you are in a possible great position. First call your lender/leasing company and get your buyout/payoff. In recent years, the number of drivers who lease rather than buy their cars has increased tremendously. A large percentage of New. Jersey residents now lease a. Please keep in mind that in Massachusetts the interest rate on an automobile purchase can be no higher than 21%. If you are being offered a vehicle financing. Over the long run, continually leasing is more expensive than buying a car. Plus, purchasing a vehicle allows you to build equity in an asset. At the same. However, if the total lease buyout cost (including any remaining lease payments) is more than the market value of the car, the dealership will roll the. If it's worth more than expected, buying out your car lease can be a very smart option! If not, you're probably be better off with a different model. Finance. It's generally not a good idea to lease a car if your intention is to buy it at the end of the lease, espeically if you're going to finance the end-of-lease. Leasing can allow buyers to acquire a more expensive vehicle than they might otherwise be able to afford. However, it isn't without its drawbacks. You can buy out the lease before the contract ends or purchase the vehicle at the end of leasing. Then, you can sell the car once you own it. Used cars in. Know how leasing is different than buying. The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car. With a. You'll buy the car from the company that originally leased it to you, then you'll sell it to another dealer. 4. Turn Your Lease In. When you leased your car. A lease buyout loan lets you buy the car you're already driving from the leasing company for a predetermined price. We'll walk you through the most important things you need to know before buying out your lease — and empower you to make the best choice for your situation. buy the car either during the lease duration or at the end Then estimate your leased car's market value to see how much you would pay. When you BUY with a loan, you pay the entire $20,, plus finance charges. You own the car at the end of your loan, although its value is less than the $20, A car lease allows you to drive a vehicle from a dealership for an agreed upon amount of time and miles, and pay for its usage rather than for the full.

Metro Pcs Fix Broken Screens

Metro Pcs Phone Replacement(26) ; current price $ ; current price $ ; current price $ ; current price $ ; current price. Screens (5) · Speakers (2) · Vibrators (1) · Tools. These are some common tools Models. AT&T (I), International (I), Metro PCS (R), Sprint (SL). Technicians fix cracked screens in a range of iPhone models, aiming to make them function like new. broken English and end up not solving the reason you called! Last I called to inquire about using the insurance to either fix my phone or replace it. You can try repairing the glass with super glue, epoxy, or windshield repair kit. You can search youtube for instructional vids. Our services include cracked screens, charging ports, battery Metro PCS. Phone Repair Place · Target. The Mall at Prince George's. East. Whether you have a broken screen, want to upgrade your hard drive, or have a slow-moving laptop - we fix it all! Request a free estimate to get started! Don't. Description of Work: Requested repair of a broken front screen. Did not request repair of the cracked back case but they replaced it with a nice used case at no. We specialize in fixing all electronic problems whether the issue is water damage phone repair, tablet repair, cracked screen repair, broken iphone screen. Metro Pcs Phone Replacement(26) ; current price $ ; current price $ ; current price $ ; current price $ ; current price. Screens (5) · Speakers (2) · Vibrators (1) · Tools. These are some common tools Models. AT&T (I), International (I), Metro PCS (R), Sprint (SL). Technicians fix cracked screens in a range of iPhone models, aiming to make them function like new. broken English and end up not solving the reason you called! Last I called to inquire about using the insurance to either fix my phone or replace it. You can try repairing the glass with super glue, epoxy, or windshield repair kit. You can search youtube for instructional vids. Our services include cracked screens, charging ports, battery Metro PCS. Phone Repair Place · Target. The Mall at Prince George's. East. Whether you have a broken screen, want to upgrade your hard drive, or have a slow-moving laptop - we fix it all! Request a free estimate to get started! Don't. Description of Work: Requested repair of a broken front screen. Did not request repair of the cracked back case but they replaced it with a nice used case at no. We specialize in fixing all electronic problems whether the issue is water damage phone repair, tablet repair, cracked screen repair, broken iphone screen.

iPhone Screen Repair: Cracked or broken screen? Our technicians can We're located in Weston Commons next to Game Stop and Metro PCS. If you are. Broken iPhone? Now get Your iPhone 5 or iPhone 6 Screen Replaced for ONLY $99! - We offer the BEST Pricing on Phone Repair in the Area!! Have another model. Unlock SIM Lock with Any Carrier! Simple, click-through, process. Remove screen passcodes, Face ID, Touch ID, Apple ID, and Bypass iCloud Activation. Store Hours: Mon 11am-6pm Labor Day Tue–Sat 11am-8pm. Sun noon-6pm. Phone: () More Stores You Might Like. Phone Repair Place. No matter the device, we can fix it. · Battery replacement · Screen glass replacement · Glass and LCD replacement · Charge Port repair · Power button repair · Speaker. For a cracked screen, we can usually repair it same day. If it's lost or has other physical damage we may replace your device. PAY YOUR DEDUCTIBLE. Your. However, once the screen is broken, damaged, or chipped, it becomes near impossible to use and hence the need for Kyocera cell display screen parts. What do I. We specialize in fixing all electronic problems whether the issue is water damage phone repair, tablet repair, cracked screen repair, broken iphone screen. Buy Metro Screenworks Custom Window Screens Fully Assembled and Ready to Install - Window Screen Replacement for House, (Black) Pre-Framed Mesh Replacement. WOW Cracked Screen & Back Repairs ‼️ 15 mins repairs from $69 (Loc:Cumberland Mall- Vineland) +1 () ) Repairs from $ Detect and resolve identity theft to protect you from fraud. You can enroll in PHP or PHP Device Insurance while making a qualified Metro by T-Mobile device. No cell phone problem, be it a broken screen, charging port, or headphone jack, is too much of a challenge for Premier Mobile tech experts. All leading brands. Broken Screen Repair- iPhone 6. Click For More Info. Broken Screen Repair MetroPCS iPhone Repair. Click For More Info. MetroPCS iPhone Repair. Shattered. Cracked Screen. CommDepot averages 20 minutes on iPhone Screen Repairs. Don't wait all day without your phone, just 20 minutes and you'll have your. Metro Computer repair is Atlanta's #1 computer repair shop, offering professional, affordable repair for Mac and PC computers, Since METRO PCS, CRICKET, XFINITY for iPhone, Samsung, LG, Motorola and other Repair Services. Cracked iphone Fix /Broken Screen Repair; Cell phone Screen. Metro PCS, a subsidiary of T-Mobile, is known for its affordable no-contract phone plans and budget-friendly devices. As an existing customer. Mobile Device Insurance · My Wireless Claims Site. Choose your provider and then you'll be routed to the correct self-service portal where you can make a claim. All screen repairs come with our limited lifetime warranty. Whether you are having an issue one week or one year after a repair - we're only a phone call or. We specilize on all types of broken cellphones Broken screen Broken button Water damage Audio issues Camera issues We also repair tablets We also sell Metro Pcs.

Discover It Best Credit Card

Why We Like It: The Discover it® Chrome is the best Discover card for balance transfers because it offers an introductory APR of 0% for 18 months (followed by a. The credit card experts at Finder compared all Discover credit cards against one another based on several features, including cashback opportunities, travel. Discover IT, is typically what everyone wants. Has 5% rotating quarterly (calendar dates) categories and 1% standard earn on all else. The. Best credit card ever. In total I have 15 credit cards, half of them have a limit of over $5k. But I have never been treated so well like I have been with. NerdWallet's Best Discover Credit Cards of September · Discover it® Cash Back: Best for Cash back · Discover it® Chrome: Best for Balance transfers. Discover could offer more elevated rewards but beyond that, the card is competitive in every respect. All-in-all the Discover It® Cash Back Credit Card is an. Best Discover credit cards · Best for everyday spending: Discover it® Cash Back · Best for balance transfers: Discover it® Balance Transfer · Best for travel. Discover is a good credit card company, ranking third-best in customer satisfaction and offering cards with $0 annual and foreign transaction fees. Plus. Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly. Why We Like It: The Discover it® Chrome is the best Discover card for balance transfers because it offers an introductory APR of 0% for 18 months (followed by a. The credit card experts at Finder compared all Discover credit cards against one another based on several features, including cashback opportunities, travel. Discover IT, is typically what everyone wants. Has 5% rotating quarterly (calendar dates) categories and 1% standard earn on all else. The. Best credit card ever. In total I have 15 credit cards, half of them have a limit of over $5k. But I have never been treated so well like I have been with. NerdWallet's Best Discover Credit Cards of September · Discover it® Cash Back: Best for Cash back · Discover it® Chrome: Best for Balance transfers. Discover could offer more elevated rewards but beyond that, the card is competitive in every respect. All-in-all the Discover It® Cash Back Credit Card is an. Best Discover credit cards · Best for everyday spending: Discover it® Cash Back · Best for balance transfers: Discover it® Balance Transfer · Best for travel. Discover is a good credit card company, ranking third-best in customer satisfaction and offering cards with $0 annual and foreign transaction fees. Plus. Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly.

Discover it Cash Back Review: 5% Rewards Are Worth a Little Work This card offers a high rewards rate in rotating categories, a good 0% APR offer and an. Intro Offer: Unlimited Cashback Match for all new cardmembers – only from Discover. · Earn 5% cash back on everyday purchases at different places you shop each. The Discover it Student Chrome is a great rewards credit card for students who want the same cashback benefits of the standard Discover it Chrome. This includes. Our credit card comparison tool lets you compare each Discover credit card with credit cards from other issuers. Compare features to find the best card for. Discover it® Cash Back card earns rewards on categories that rotate every quarter. It charges no annual fee and offers a long 0% introductory annual percentage. Discover IT, is typically what everyone wants. Has 5% rotating quarterly (calendar dates) categories and 1% standard earn on all else. The. Best card ever. I applied for this card when my credit score was in the low s. Shockingly I was approved, they gave me a $ limit. fast-forward a little. Unlimited Bonus: Unlimited Mile-for-Mile match for all new cardmembers—only from Discover. Discover gives you an unlimited match of all the Miles you'. This no-annual-fee card has a great cash back rate on rotating bonus categories and a reasonable APR, but it may not be the best for those looking for a more. Discover cards are widely accepted and offer competitive rates and rewards. If used conscientiously, the automatic cash-back match during the first year offers. Compare and apply for the best Discover credit card for you. Discover credit cards include rewards like cash back or miles so you can pick the best rewards. And, the Discover it® Miles card is a rewards credit card that gives you points for travel expenses and every other purchase you make with your card. So it can. Highlights - Discover it® Secured Credit Card · Earn 2% cash back at Gas Stations and Restaurants on up to $1, in combined purchases each quarter. Learn about Discover it® cash back credit cards and consider benefits like Discover Cashback Match when choosing the best cash back credit card for you. The best Discover credit cards offer cash back on your spending and an unlimited cash-back match at the end of your first year. Rewards Credit Cards · Get cash back or travel rewards · Choose the best Discover rewards card for you · Discover it Cash Back Credit Card · Discover it Student. It's a very good card, with rewards that are easy to use and customer service nothing short of excellent. Best card ever. I applied for this card when my credit score was in the low s. Shockingly I was approved, they gave me a $ limit. fast-forward a little. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. We have selected the best Discover credit cards to empower consumers to earn on their everyday purchases without the hassle of annual fees.

Fundrise Basic Plan

With plans ranging from $3 to $9 per month, you can start investing with as little as $1. Stash also provides options for banking where you can get rewarded. Fundrise is an online real estate investment platform that gives the everyday investor the chance to invest in private real estate deals for as little as $ An investment plan automatically allocates your investment across one or more of our funds and each of these funds intends to invest in a diversified pool of. The core financial, product, and economic patterns repeat each innovation They scenario plan three potential futures: the continuation of current. You can get started investing with us through a taxable account for as little as $ For retirement accounts (IRAs), there is a $1, minimum to get started. You can choose to roll over an existing retirement account (IRA, k, or another employer-sponsored plan) or make a contribution to open a new account and. Fundrise has three core investment strategies: Supplemental Income, Balanced Growth & Income, and Long-Term Growth for real estate investors. Decide whether a Fundrise Pro membership is right for you: Fundrise Pro lets you take total control of your portfolio by creating personalized investment plans. Fundrise charges a % advisory fee which means, over a month period, investors will pay a $ advisory fee for every $1, they have invested with. With plans ranging from $3 to $9 per month, you can start investing with as little as $1. Stash also provides options for banking where you can get rewarded. Fundrise is an online real estate investment platform that gives the everyday investor the chance to invest in private real estate deals for as little as $ An investment plan automatically allocates your investment across one or more of our funds and each of these funds intends to invest in a diversified pool of. The core financial, product, and economic patterns repeat each innovation They scenario plan three potential futures: the continuation of current. You can get started investing with us through a taxable account for as little as $ For retirement accounts (IRAs), there is a $1, minimum to get started. You can choose to roll over an existing retirement account (IRA, k, or another employer-sponsored plan) or make a contribution to open a new account and. Fundrise has three core investment strategies: Supplemental Income, Balanced Growth & Income, and Long-Term Growth for real estate investors. Decide whether a Fundrise Pro membership is right for you: Fundrise Pro lets you take total control of your portfolio by creating personalized investment plans. Fundrise charges a % advisory fee which means, over a month period, investors will pay a $ advisory fee for every $1, they have invested with.

Fundrise ranks their investment plans based on the way they earn income for investors, but still don't make any projections around potential cash flow. . How. base of investors. See “Prior Performance Summary”. · Market Knowledge and Fundrise, LLC's disaster recovery plan has not been tested under actual. Don't have enough cash for a down payment? Not keen to be a landlord? Fundrise is an investment app that lets you easily invest in real estate through real. It is essential By following these insights and utilizing the right strategies, you can maximize your (k) plan and work towards a secure and comfortable. I plan to upgrade soon, is there a big difference between basic versus core? And is it important to choose specific funds? Would love any advice. Investors can choose between one of our four investment plans; Supplemental Income plan, Long-Term Growth plan, Balanced Investing plan, or Venture Capital. Switch to the basic mobile site. This browser is not supported plan and they put my dividend reinvestment for last qtr. into the. With an investment of $1,, you upgrade to the Basic Portfolio which opens up Fundrise retirement accounts, investment goal planning, and access to Fundrise. How do I change my investment plan? You can change your investment plan at any time from the Investment Plan section of your account settings. fundamental failure of the technology, the loss of a key customer, or the plan offered by the Adviser, such distributions will be reinvested in. Acquire assets that generate consistent cash flow. We invest primarily in assets that generate predictable returns from the moment we make the investment. If you're looking for a platform that makes investing approachable to new investors, you may want to consider Stash. With plans ranging from $3 to $9 per month. Dynamic allocation: Fundrise will use your custom investment plan as a target portfolio. · Flat allocation: Each time you invest, your investments will match the. The Supplemental Income Plan is designed to earn more income than appreciation. With that return profile, return potential is expected to be captured mostly. With Fundrise, you can build a portfolio of private market investments, like real estate, venture capital, and private credit. Fundrise is America's largest. Fundrise investors invest in our low-cost, tax-efficient funds in two ways - through an investment plan or by directly investing into an available fund. Generally speaking, investors in our Income plan should expect to have more of their portfolio weighted toward Fixed Income and Core Plus strategies, our Growth. Fundrise won't be a good choice for all investors, but for those looking for this niche, it could be a snug fit. Fundrise creates real estate investment trusts. Compare core plans; Long-Term Growth. Long-Term Growth. Pursue superior overall returns by investing primarily in high potential growth real estate. Dividends. Fundrise's mission is to build a better financial system by empowering the individual investor. Innovation is at the core of Fundrise. Since its first funded.

Retail Industry Financial Ratios

Ten years of annual and quarterly financial ratios and margins for analysis of Retail Value Inc. (RVIC). A ratio of 1 or greater is considered acceptable for most businesses. 2. Cash ratio = Liquid assets / Current liabilities Indicates a company's ability to pay. Retail Sector analysis, leverage, interest coverage, debt to equity ratios, working capital, current, historic statistics and averages Q2 Financial ratios of companies ; 1. Gross operating margin (%), , ; 2. Net operating margin (%), , ; 3. Added value / Operating income (%), The restaurant working capital ratio is 75%. While only the retail current ratio is significantly greater than %, I would be more concerned. Durable. ; Retail ; Hardware. ; Gen. Merchandise. IBISWorld provides financial ratios and industry benchmarks for hundreds of Canadian industries. Including Liquidity Ratios, Leverage Ratios. About Retail Opportunity Financial Statements Retail Opportunity stakeholders use historical fundamental indicators, such as Retail Opportunity's Current. General Merchandise Stores: Average Industry Financial Ratios for U.S. Listed Companies ; Debt-to-equity ratio · Interest coverage ratio ; · Ten years of annual and quarterly financial ratios and margins for analysis of Retail Value Inc. (RVIC). A ratio of 1 or greater is considered acceptable for most businesses. 2. Cash ratio = Liquid assets / Current liabilities Indicates a company's ability to pay. Retail Sector analysis, leverage, interest coverage, debt to equity ratios, working capital, current, historic statistics and averages Q2 Financial ratios of companies ; 1. Gross operating margin (%), , ; 2. Net operating margin (%), , ; 3. Added value / Operating income (%), The restaurant working capital ratio is 75%. While only the retail current ratio is significantly greater than %, I would be more concerned. Durable. ; Retail ; Hardware. ; Gen. Merchandise. IBISWorld provides financial ratios and industry benchmarks for hundreds of Canadian industries. Including Liquidity Ratios, Leverage Ratios. About Retail Opportunity Financial Statements Retail Opportunity stakeholders use historical fundamental indicators, such as Retail Opportunity's Current. General Merchandise Stores: Average Industry Financial Ratios for U.S. Listed Companies ; Debt-to-equity ratio · Interest coverage ratio ; ·

Today, more than ever, retailers need to analyze the key solvency (liquidity) and efficiency financial ratio measures that affect how well their firms. INDUSTRY RATIOS ANALYSIS ; 56 · APPAREL AND ACCESSORY STORES ; 23 · APPAREL AND OTHER FINISHED PRODUCTS MADE FROM FABRICS AND SIMILAR MATERIAL ; 55 · AUTOMOTIVE. The Retail Owners Institute's how-to training info and online projecting calculators enable retailers from all retail segments to improve profits. Current Ratio. Quick Ratio. Gross Profit. Margin. %. %. %. %. %. Financial ratios benchmarks for different segments of the retail industry. The latest figures for Pre-tax profit, gross margin, GMORI & inventory turnover. Financial ratios are just one of many benchmarks you can use. Some measures are more general, such as sales per employee or productivity per hours worked. The apparel and accessories sector achieved the highest annual sales growth with %. The top retailers achieved an average net profit margin of %. On the other hand, the Discount Stores industry has the lowest average quick ratio of , followed by the Auto & Truck Dealerships industry at This. Financials ; Liquidity Ratios ; Current Ratio (X), , , , ; Quick Ratio (X), , , , Keywords: small business, ratios, retail, service, financial analysis, entrepreneurship TABLE 1: Retail Sector Financial Performance Test Results. SIZE1. 1 vs. Some financial ratios give retailers insight into how assets compare to liabilities or how fast inventory is being stocked versus sold. ROIC Ratios ; P/E Ratio TTM, , ; Gross margin TTM, %, ; Revenue/Share TTM, , ; Return on Equity TTM, %, ; EPS(MRQ) vs Qtr. Footfall ratio is another important ratio which is used in the retail industry. This ratio is calculated by dividing the sales generated with the footfall. US Census Retail Trade Report; Data Axle; Business Valuation Resources (BVR) The Bizminer Industry Financial Report is based on selected financial ratios. The wholesale and retail trade industry typically uses three ratios to measure return: return on sales, return on assets and return on net worth. In , the. There's a comparison between the two groups, with averages calculated to determine which ratios are most valuable to retailers in understanding risk of. Financial ratios are used to measure a company against an industry average or other companies in order to benchmark or measure a company's performance. Investors and market analysts use specific financial ratios to evaluate companies in the retail banking industry. Common ones are the net interest margin. Table 3 sets the stage with a synopsis of the key ratio data by retail industry sector over the entire period. Liquidity ratios · Leverage ratios · Efficiency ratios · Profitability ratios · Market value ratios.

How To Invest In Penny Stocks

Learn about the risks of penny stocks and speculative stock investments and how this market works. A penny stock typically refers to a stock that trades for less than $5 per share. This type of stock normally has high price fluctuation, low liquidity, and a. For penny stock investors, one aspect to pay particular attention to is the fee structure. Some brokers charge commissions on a per-share basis. This structure. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. How can you buy penny stocks online? · Open an account – you can choose between a spread betting, CFD trading or share dealing account (or all three) · Do your. Penny stocks refer to stocks that trade for low prices (Moomoo Financial tsg-upravdom.rus stocks trading for less than 1 HKD as penny stocks). How to trade penny stocks · Open a live trading account. · Fund your account. · Research to find the right stocks for you. · Decide if you want to buy or sell. Penny stocks are regarded as a more speculative investment than larger businesses because they are geared for growth and often loss-making. The Securities Division considers a stock to be a “penny stock” if it trades at or under $ per share and trades in either the “pink sheets” or on NASDAQ. Learn about the risks of penny stocks and speculative stock investments and how this market works. A penny stock typically refers to a stock that trades for less than $5 per share. This type of stock normally has high price fluctuation, low liquidity, and a. For penny stock investors, one aspect to pay particular attention to is the fee structure. Some brokers charge commissions on a per-share basis. This structure. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. How can you buy penny stocks online? · Open an account – you can choose between a spread betting, CFD trading or share dealing account (or all three) · Do your. Penny stocks refer to stocks that trade for low prices (Moomoo Financial tsg-upravdom.rus stocks trading for less than 1 HKD as penny stocks). How to trade penny stocks · Open a live trading account. · Fund your account. · Research to find the right stocks for you. · Decide if you want to buy or sell. Penny stocks are regarded as a more speculative investment than larger businesses because they are geared for growth and often loss-making. The Securities Division considers a stock to be a “penny stock” if it trades at or under $ per share and trades in either the “pink sheets” or on NASDAQ.

Penny stocks refer to stocks that trade for low prices (Moomoo Financial tsg-upravdom.rus stocks trading for less than 1 HKD as penny stocks). Stock Movers ; PSNY · Polestar Automotive ; GLSTR · Global Star Acquisition, Inc. - Right ; BRACR · Broad Capital Acquisition Corp - Rights ; CNTB · Connect. Penny stocks are common shares of small public companies that trade for less than $5 per share. Penny stock companies usually have smaller market. Penny stock trading is a riskier, more speculative type of investment where shares of these companies are trading at less than $5 per share. Robinhood penny stocks trade at $5 or less per share, and they hold opportunities for traders building small accounts. These stocks are cheap and often sketchy. Penny stocks is any share of a public company trading below $5 per share. These companies also have smaller market capitalization. Penny stocks are stocks that are priced very low, mostly under Rs 20 per share, and such companies have low market capitalization as well. A company's market. Most Active Penny Stocks · FCUV · Focus Universal Founder Acquires % More Stock · LESL · LESL Shares Surge on Insider Buying · LUNRW · Intuitive Machines Stock. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. Penny stocks are low-cost equities that often make large price moves, potentially leading to big gains―or losses―for investors. Penny Stocks For Dummies will. In this guide, I’ll give you a crash course on some of the most important penny stock basics. You’ll learn what it means to invest in penny stocks versus trade. Penny stocks are shares of companies that usually trade for less than $5 per share. They are highly speculative investments, meaning they carry a high degree. Peter Leeds, author of 'Penny Stocks for Dummies,' is the authority on penny stocks. Credits include interviews on mainstream media like NBC, CBS, CNNfn, Fox. Risks Associated With Penny Stocks. There are a number of risks of trading penny stocks, including the following: You Can Lose All or Much of Your Investment. They can help spread your investment across various asset classes to decrease your overall exposure to trading risks. Nonetheless, don't invest too much in. OTC (over the counter) directly between brokers. The OTC Markets Group operates an electronic Bulletin Board to buy and sell penny stocks. This is the most. -Penny stocks are low-priced shares of small companies not traded on an exchange or quoted on NASDAQ. Prices often are not available. Investors in penny stocks. Penny stocks are low-cost equities that often make large price moves, potentially leading to big gains—or losses—for investors. Penny Stocks For Dummies will. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other experts. They can help spread your investment across various asset classes to decrease your overall exposure to trading risks. Nonetheless, don't invest too much in.