tsg-upravdom.ru

Prices

Best Dental Plan For Major Work

Top Dental Insurance Plans in Texas · Delta Dental · MetLife Dental · Humana Dental · Cigna Dental · Aetna Dental. Coverage levels reflect coverage when visiting an in-network PPO dentist. EHB-Certified Plans include Essential Health Benefit services for individuals under. Ameritas PrimeStar Complete dental plan may be the best fit if you need major work done sooner than later. There are no waiting periods, and you'll have $2, If a health plan includes dental, the premium covers both health and dental coverage. Separate dental plans: In some cases, separate dental plans are offered. Good for people who want more complete coverage and are willing to see an in-network dentist. Best Value – Low premiums; Preventive, basic, and major services. Basic Dental Services. The Plan provides % coverage to a calendar year maximum of $1, per person for all Basic and Major services combined. This includes. Spirit Dental is an excellent choice because our plans feature no waiting periods for major services, high annual maximums and the freedom to choose any dentist. Humana dental. Humana is one of the largest dental insurers as well. They offer a wide range of dental plans. According to. Group plans subsidized by your employer or union are typically the only dental insurance that is decent. If you are buying coverage separate. Top Dental Insurance Plans in Texas · Delta Dental · MetLife Dental · Humana Dental · Cigna Dental · Aetna Dental. Coverage levels reflect coverage when visiting an in-network PPO dentist. EHB-Certified Plans include Essential Health Benefit services for individuals under. Ameritas PrimeStar Complete dental plan may be the best fit if you need major work done sooner than later. There are no waiting periods, and you'll have $2, If a health plan includes dental, the premium covers both health and dental coverage. Separate dental plans: In some cases, separate dental plans are offered. Good for people who want more complete coverage and are willing to see an in-network dentist. Best Value – Low premiums; Preventive, basic, and major services. Basic Dental Services. The Plan provides % coverage to a calendar year maximum of $1, per person for all Basic and Major services combined. This includes. Spirit Dental is an excellent choice because our plans feature no waiting periods for major services, high annual maximums and the freedom to choose any dentist. Humana dental. Humana is one of the largest dental insurers as well. They offer a wide range of dental plans. According to. Group plans subsidized by your employer or union are typically the only dental insurance that is decent. If you are buying coverage separate.

GSC Health Assist ZONE® plans may be suitable for those who don't have health or dental insurance, business owners, the self-employed, freelancers, and contract. Expand your plan by adding coverage for basic dental services such as exams, polishing, and fillings, as well as major services such as crowns, bridges, and. A treatment plan is a personalized approach you and your dentist develop to treat your dental health needs. It serves as your roadmap to good oral health and. Dental Plus provides even more coverage, such as children's orthodontics and major dental services, major restorations and prosthodontics. If you're ready to. A checklist to help you select the top dental insurance that's best for you ; Coverage: major services (e.g., crowns, implants, periodontal work, orthodontia). major surgeries, but most plans do not include dental coverage. So how do you pick out a dental plan that works best for you and your budget? Here Are Five. Some of the best affordable dental insurance options include plans offered by companies such as Delta Dental, Moda Health, and Willamette Dental Group. Aflac walks through all the benefits of full coverage dental insurance like preventative care, basics, and major services work with providers in and out-of-. Top Dental Insurance Providers · Humana: Known for unlimited annual payouts and immediate preventive care coverage, though it has limited major services coverage. Types of dental plans you can find through Progressive Health by eHealth · DPPO: You can go to most dentists, though in-network dentists are less expensive. 1. Delta Dental — Best for Largest Dental Network. Delta Dental commands one of the largest dental networks nationwide. This insurance carrier offers both DHMO. Save on basic and major services with this Humana PPO dental plan. No deductibles and no waiting period for preventive care. The GEHA dental plan high option covers 50% of major work like implants and crowns, the low option only covers 30% (so you would pay 70). The enhanced plan offers higher reimbursement amounts than the basic plan. And it covers repair work and orthodontic treatment. For example: Wisdom teeth. Two-thirds of Canadians have great dental benefits from their work, school, or other group plan. These plans give them a choice of dentist, and the right to. If you're looking for a dental insurance plan that's most affordable for you, you'll find a variety of options with UnitedHealthcare branded dental plans. Humana · Humana ranked highest overall with a score of /5 stars. This company was especially impressive in Plan Variety and PPO Limitations, ranking in. Should I get a PPO or HMO dental insurance plan? ; 1, Delta Dental, In addition to covering % of the cost of basic procedures such as fillings, Delta Dental. Full coverage dental insurance plans are those that help cover the costs of a wide range of dental treatments and procedures. Our members work for federal government departments and Victory: PSAC secures major improvements to the Public Service Dental Care Plan in arbitration.

Licence Contract

A content licensing agreement grants companies the right to reuse or republish content created by others. Learn how to manage these important contracts. A copyright license agreement allows you to republish or create your work from someone else's writing. A licensing agreement is a contract between two parties (the licensor and licensee) in which the licensor grants the licensee the right to use the brand. For example, in a patent license, a non-practicing entity (i.e., a patent holder that is in the business of licensing patents rather than practicing the. Product License Agreements and Use Policies. Akamai products are not sold; rather, copies of Akamai products are licensed all the way through the distribution. This End User License Agreement (EULA) governs your use of the videogame, application, software, their associated upgrades, patches, and updates and related. License agreements specify the rights and obligations of each party when using software, products, services, designs, and other copyrighted materials. A license is granted by a party (licensor) to another party (licensee) as an element of an agreement between those parties. In the case of a license issued by a. A licensing agreement is a contract between parties where the licensor allows the licensee to use their trademarks, technology, or other types of property. A content licensing agreement grants companies the right to reuse or republish content created by others. Learn how to manage these important contracts. A copyright license agreement allows you to republish or create your work from someone else's writing. A licensing agreement is a contract between two parties (the licensor and licensee) in which the licensor grants the licensee the right to use the brand. For example, in a patent license, a non-practicing entity (i.e., a patent holder that is in the business of licensing patents rather than practicing the. Product License Agreements and Use Policies. Akamai products are not sold; rather, copies of Akamai products are licensed all the way through the distribution. This End User License Agreement (EULA) governs your use of the videogame, application, software, their associated upgrades, patches, and updates and related. License agreements specify the rights and obligations of each party when using software, products, services, designs, and other copyrighted materials. A license is granted by a party (licensor) to another party (licensee) as an element of an agreement between those parties. In the case of a license issued by a. A licensing agreement is a contract between parties where the licensor allows the licensee to use their trademarks, technology, or other types of property.

This sample contract is primarily geared towards a project that will be conceived, designed, developed, and/or produced by an independent producer. (b) at no additional cost if you have a valid Canva subscription. Each Pro Content License allows you to use the Content in one Canva Design, so you must pay to. Construction Image. License Check · Find My Licensed Contractor. Use this free licensing agreement template to streamline the way you create and manage these important documents. License agreements should be in written form, signed by both the licensor and the licensee. To create an intellectual property license, both parties must be. Subject to the terms of this Agreement, Licensor hereby grants Licensee, and Licensee hereby accepts a perpetual, non-exclusive, royalty-bearing licence. Learn about the terms and policies that apply to Apple developer technologies. Review applicable Developer Program license agreements. End-user license agreement An end-user license agreement or EULA (/ˈjuːlə/) is a legal contract between a software supplier and a customer or end-user. Look up a contractor license or Home Improvement Salesperson (HIS) registration to verify information, including complaint disclosure. Examples of licensing agreements and applications are on the Forms & Model Agreements page of the NIH Office of Technology Transfer Resources web site. You run the business, and leave the contracts to us. Use this easy, free, and customizable license agreement template to smooth out the details. Tailor-made agreements, built on common principles · Basic exclusive license · Nonexclusive license · Copyrighted software license · Materials licenses · Basic. Microsoft Online Subscription Agreement. Microsoft Online Subscription Agreement (MOSA) is a transactional licensing agreement for commercial, government, and. License Information. Your use of Apple software or hardware products is based on the software license and other terms and conditions in effect for the product. License Agreement: A contract that sets forth the terms and conditions under which a Licensor grants a License to a Licensee in exchange for compensation . A Software License Agreement sets the scope of the contract. It specifies which people or things the contract binds and how they change money for software. It. Learn about the terms and policies that apply to Apple developer technologies. Review applicable Developer Program license agreements. Broadcom End User Agreement · Specific Program Documentation (SPDs) and SaaS Listings · Broadcom Partner EDI Agreement · Broadcom End User Agreements · Product Name. HCL Software Software Licence Agreement License Agreements You are viewing items with filter: none. Filter by Products All Products. When you order (an) ISO publication(s), you accept these Terms and Conditions of Sale (“Sales Agreement”) and the Customer Licence Agreement.

What Is Best Time To Sell Stock

The Best Time To Avoid Placing Trades · During the last minutes before market close · Or about an hour after the market opens · And lastly to avoid the. Selling a stock or ETF after the markets have closed Markets are generally open from Monday to Friday between am – pm Eastern Standard Time (EST). The. Consider selling after a company acquisition, based on the nature of the buyout deal. Reassess and possibly sell stocks to address immediate cash needs or. With all these factors taken into consideration, the best time of day to trade is to am. The stock market opens for trading at AM and in the. The best day to sell stocks would probably be within the five days around the turn of the month. Are There Really Best Times to Buy or Sell Stocks? Historically. There's no right or wrong time to buy shares. In fact, it's not so much about when you buy stocks and shares, but rather what you decide to purchase. The general trader consensus on the best time to sell a US stock is probably just before the last hour of the NYSE's trading session from 3 pm to 4 pm EST. Investors should aim to sell a stock after it experiences considerable growth and before it decreases in value. It is difficult to predict when a stock will. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell. The Best Time To Avoid Placing Trades · During the last minutes before market close · Or about an hour after the market opens · And lastly to avoid the. Selling a stock or ETF after the markets have closed Markets are generally open from Monday to Friday between am – pm Eastern Standard Time (EST). The. Consider selling after a company acquisition, based on the nature of the buyout deal. Reassess and possibly sell stocks to address immediate cash needs or. With all these factors taken into consideration, the best time of day to trade is to am. The stock market opens for trading at AM and in the. The best day to sell stocks would probably be within the five days around the turn of the month. Are There Really Best Times to Buy or Sell Stocks? Historically. There's no right or wrong time to buy shares. In fact, it's not so much about when you buy stocks and shares, but rather what you decide to purchase. The general trader consensus on the best time to sell a US stock is probably just before the last hour of the NYSE's trading session from 3 pm to 4 pm EST. Investors should aim to sell a stock after it experiences considerable growth and before it decreases in value. It is difficult to predict when a stock will. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell.

The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks. Generally speaking, the most active time of the day for stock trading is the first and last hours of the trading session. In theory, buying and selling at these. Technically, there is no waiting period. You can sell a stock seconds after buying it. However, frequent day trading might classify you as a '. In order to maximize the profit, we need to buy the stock at its lowest price and sell it when the price is highest. If you're trading: sell when it hits your target price. If you're long term: sell when the thesis changes or you find a significantly better. There are several factors to consider when deciding whether to hold or sell an investment position, including your risk tolerance and time horizon. A stock trading at high volume shows rising interest and strength in the market, while low volume indicates less interest in a stock. Two-hour-a-day traders. Can you solve this real interview question? Best Time to Buy and Sell Stock - You are given an array prices where prices[i] is the price of a given stock on. After all, even when the market has had a good run, lifting your holdings, you might still have some stocks that are below where you bought them. If you're. When Should I Sell My Stocks? · Sell Rule #1: The Company's Long-term Earnings Power is Impaired · Sell Rule #2: The Stock's Valuation has Reached Excessive. There are no concrete rules on when to sell shares. But there are a number of indicators that should trigger the need for a review of your investment portfolio. Top priorities should be to manage risk, preserve capital and take losses quickly. · sell a stock when you are down 7% or 8% from your purchase price, no. Your investment journey should start with identifying your goals, how long you have until you need the money and your tolerance for investment risk. The first quarter of an hour post the opening bell is the best time to trade. It is the period when the most profitable trades of a day on initial trends, are. The idea is that you never know when a stock might rise or fall, but by buying the same stock regularly, you're more likely to get it for a good price and less. Buy at low and sell at high. First decide the resistance and support of the stock. You can take help of option chain of the stock. Investors have heard the dictum “sell in May and go away.” This year they might want to consider selling in March. The May adage follows from market. stock market – and how often peaks were followed by major drops ' They may question whether it's the best time to put new money into the market. 1. You Made a Bad Investment · 2. The Stock Has Reached Your Target Price · 3. The Stock's Valuation is High · 4. Selling for the Opportunity Cost · 5. You Need the. Best and Worst Months for the Stock Market – Seasonal Patterns ; Best Months: April, July, October, November, and December; Worst Months: January, February, June.

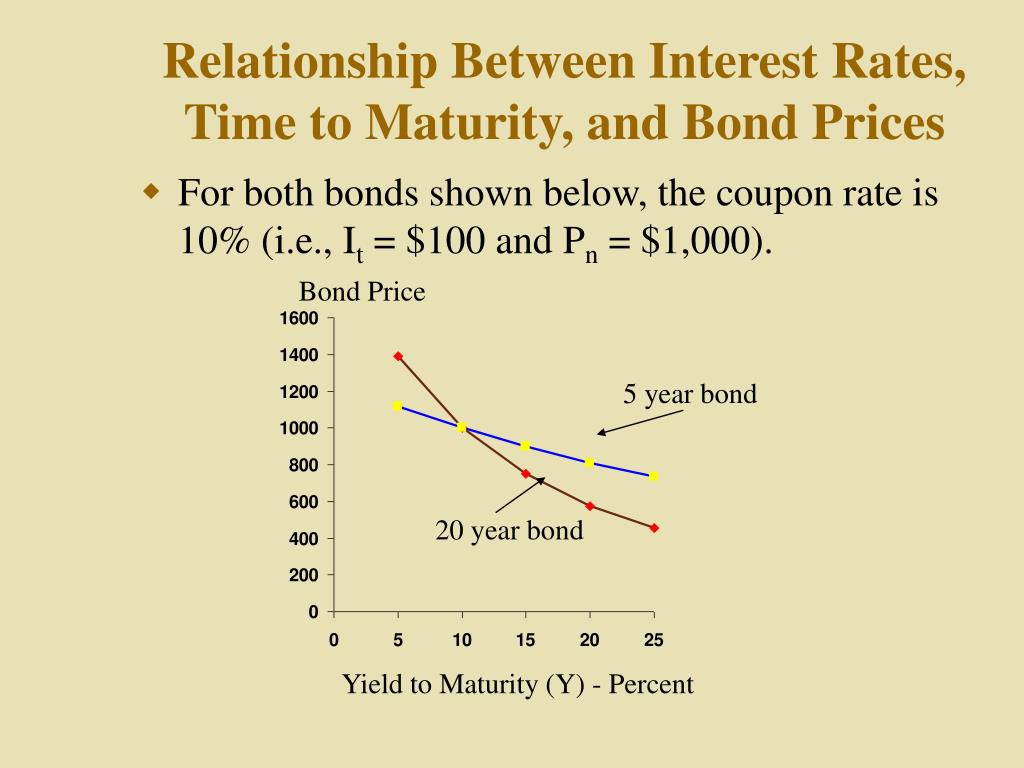

Current Price Of A Bond

As with any security or capital investment, the theoretical fair value of a bond is the present value of the stream of cash flows it is expected to generate. Bonds and bond funds can help diversify your portfolio. Bond prices fluctuate, although they tend to be less volatile than stocks. Some bonds, particularly. Treasury Yields ; GB3:GOV. 3 Month. , , % ; GB6:GOV. 6 Month. , , % ; GBGOV. 12 Month. , , %. The selling price (or the market value) of a bond is the present value of the future contractual cash amounts that are going to be received by the owner of the. If the yield on all 10 year government bonds trading in the secondary market is 2 per cent (the same as the interest payments in our bond), then the price of. For example, one hundred $1, face value bonds issued at have a price of $, ( bonds x $1, each x %). Regardless of the issue price, at. The value of the bond is the price an investor would pay to another to purchase the bond. Bond valuation is a process of determining the fair market price of. The current yield formula equals the annual coupon payment divided by the bond's current market price, expressed as a percentage. How Do Bond Prices Affect. Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. As with any security or capital investment, the theoretical fair value of a bond is the present value of the stream of cash flows it is expected to generate. Bonds and bond funds can help diversify your portfolio. Bond prices fluctuate, although they tend to be less volatile than stocks. Some bonds, particularly. Treasury Yields ; GB3:GOV. 3 Month. , , % ; GB6:GOV. 6 Month. , , % ; GBGOV. 12 Month. , , %. The selling price (or the market value) of a bond is the present value of the future contractual cash amounts that are going to be received by the owner of the. If the yield on all 10 year government bonds trading in the secondary market is 2 per cent (the same as the interest payments in our bond), then the price of. For example, one hundred $1, face value bonds issued at have a price of $, ( bonds x $1, each x %). Regardless of the issue price, at. The value of the bond is the price an investor would pay to another to purchase the bond. Bond valuation is a process of determining the fair market price of. The current yield formula equals the annual coupon payment divided by the bond's current market price, expressed as a percentage. How Do Bond Prices Affect. Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number.

The value of a bond will fluctuate alongside changes in interest rates. Calculate the current value of your bond against changes to interest rate. You might also be interested in our bond yield calculator to find the current yield, which is the yield based on the purchase price of the bond rather than the. 2) Current Yield: Bonds fluctuate in price as interest rates change, and the current yield is calculated as the annual interest payment divided by the bond's. Example: Calculating Bond Value as the Present Value of its Payments ; Clean Bond Price, = C · r ; C = Annual payment from coupons. n = number of years until. Find out what your paper savings bonds are worth! The calculator will price Series EE, Series E, and Series I savings bonds, and Savings Notes. The bond price can be calculated by summing up future cash flows discounted to the present value. This method is used to price both new issues (primary bond. The purchase price takes both of these promises into account. The purchase price of the bond on an interest payment date is the sum of the present value of all. BONDS & RATES ; Year Bond · Year Bond. , 0/32, , ; Year Note · Year Note. , 0/32, , Bond Price = current price of the bond; Face Value = amount paid to the bondholder at maturity; Coupon = periodic coupon payment; n = number of time periods. Period, Coupon, Discount rate (YTM), Present Value of payments, Cumulative payment. 1, $, %, $, $ 2, $, %, $, $ Yield is a general term that relates to the return on the capital you invest in a bond. Price and yield are inversely related: As the price of a bond goes. The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to make investors aware that market interest rates and bond prices move in. A bond that sells at a premium (where price is above par value) will have a yield to maturity that is lower than the coupon rate. Alternatively, the causality. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds. The Bond Pricing calculator helps you calculate the price of a bond, given its coupon, face value, maturity, and prevalent discount rate on the market. The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the. current price and hold it until it matures. To calculate yield to maturity you'll input the current price, coupon payment, number of years until the bond. Bonds ; ^IRX 13 WEEK TREASURY BILL. (%). ; ^FVX Treasury Yield 5 Years. (%). ; ^TNX CBOE Interest Rate Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current. Recession fears in bond market fade after July's retail-sales data · BX Treasury yields finished mixed on Wednesday after July's consumer-price index.

Affirm Approval Rates

approved by other lenders. Affirm vs. Afterpay: Interest and Fees. The interest rates on Affirm loans vary based on the merchant you are purchasing from. That transaction is subject to approval by Affirm under certain conditions, as summarized here below. The interest rates offered by Affirm may vary in time. Affirms offers up to month payment programs at a rate of 0% APR or between % APR based on customers' credit. With no fees or compounding interest. Rates from 0% APR or 10–36% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: tsg-upravdom.ru *Eligibility based on $50 USD minimum cart value and individual credit approval. Online sales only. Rates from % APR. For example, a $ purchase might. Affirm doesn't list a minimum credit score to qualify for a loan, but some websites state if you have a or above, you're more LIKELY to get approved. I don'. Interest rates for Affirm loans can range from 0% to 30%, which is greater than the highest APR on most credit cards. The interest rate offered by the merchant where you're applying. You can be approved for more than one Affirm loan with more than one merchant. Affirm says. The annual percentage rate (APR) on an Affirm loan ranges from 10% to 30%. Affirm discloses any required fees upfront before you make a purchase, so you know. approved by other lenders. Affirm vs. Afterpay: Interest and Fees. The interest rates on Affirm loans vary based on the merchant you are purchasing from. That transaction is subject to approval by Affirm under certain conditions, as summarized here below. The interest rates offered by Affirm may vary in time. Affirms offers up to month payment programs at a rate of 0% APR or between % APR based on customers' credit. With no fees or compounding interest. Rates from 0% APR or 10–36% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: tsg-upravdom.ru *Eligibility based on $50 USD minimum cart value and individual credit approval. Online sales only. Rates from % APR. For example, a $ purchase might. Affirm doesn't list a minimum credit score to qualify for a loan, but some websites state if you have a or above, you're more LIKELY to get approved. I don'. Interest rates for Affirm loans can range from 0% to 30%, which is greater than the highest APR on most credit cards. The interest rate offered by the merchant where you're applying. You can be approved for more than one Affirm loan with more than one merchant. Affirm says. The annual percentage rate (APR) on an Affirm loan ranges from 10% to 30%. Affirm discloses any required fees upfront before you make a purchase, so you know.

-Affirm is a good company to use if money is tight and you need things urgent. I havent had a problem yet with them. I couldnt tell you how costumer service is. *Rates from % APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: tsg-upravdom.ru Choose how you pay with Affirm for as low as 0% APR. Spread the cost of a purchase over $ into 12 easy monthly payments. The application process is straightforward, with quick approvals and rates from 0% APR to % APR based on creditworthiness and subject to an eligibility. Your rate will be 0%–36% APR based on credit, and is subject to an eligibility check. Options depend on your purchase amount, may vary by merchant, and may. Checkout. Complete your purchase and pay over time in 4 equal payments. Subject to credit approval. 4. Pay. The remaining 3 payments are charged to your debit. As an example, a $ purchase might cost $/mo for 12 months at 15% APR. A down payment may be required. Subject to eligibility check and approval. Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase. Have more consistent interest rates between merchants: With Affirm, the interest rate and loan term you're approved for can vary depending on which partner. Payment options through Affirm are provided by these lending partners: tsg-upravdom.ru Your rate will be 0%–36% APR based on credit, and is subject to an. I have Klarna (may not be the same as Affirm, I don't know) and was approved for USAA AMEX. interest rates. I know so many people who. I recommend Self personal loan as they don't do a hard pull even after you're approved. Upvote. No, the prequalification amount is not a guarantee. It's an estimate indicating what you may qualify for. Your final approval, along with the specific details. Affirm, Klarna and Afterpay. Rather than paying one lump sum or putting it on a credit card, he opted to split up the cost of his exercise gear, clothes. Shop stress-free and pay over time with flexible payments. Now select customers can take Affirm everywhere with the Affirm Card™. Pay in 4 loans come with 0% APR but monthly installment loans charge an APR of 0% to 36%. Affirm is a good option if used responsibly, but consumers should be. Rates from 0% APR or 10–36% APR. For example, a $ purchase might cost $/mo over 12 months at 15% APR. Payment options through Affirm are subject to. Up to 10–% APR (where available and subject to provincial regulatory limitations). Subject to eligibility check and approval. A down payment may be. Payment options through Affirm are provided by these lending partners: tsg-upravdom.ru Your rate will be 0%–36% APR based on credit, and is subject to an. Unlike credit cards, Affirm's loans are not a revolving line of credit. Instead, applicants are approved only for the amount they're looking to borrow—on their.

How Do You Become A Shareholder Of A Company

A shareholder can be a person, company, or organization that holds stock(s) in a given company. A shareholder must own a minimum of one share in a company's. As a L'Oréal shareholder you are investing in: The world's N°1 beauty company operating in a dynamic and growing market; A balanced and resilient business model. To become a shareholder in a company, one needs to have the consent of the Board of Directors, and a resolution has been passed. The stocks in a private company. Private companies have more control over who can be a shareholder. The shareholders' agreement outlines their rights and obligations. Majority shareholders. Anyone can become a shareholder by buying stock in that company. In many countries, corporations may also offer employee stock options as a benefit for workers. Shareholders are often individuals or groups who engage in strategic decision-making and may be independent of a corporation. The majority shareholders control. Shareholders are also called stockholders, and when they invest in a company to obtain an equity of the company, they become the owners of that corporation. If any natural person, or any individual or legal entity, invests in the company shares, it is eligible to become a shareholder in a company. To become a. Becoming a registered shareholder in US-listed companies through Computershare Computershare acts as transfer agent/registrar to a range of US companies. For. A shareholder can be a person, company, or organization that holds stock(s) in a given company. A shareholder must own a minimum of one share in a company's. As a L'Oréal shareholder you are investing in: The world's N°1 beauty company operating in a dynamic and growing market; A balanced and resilient business model. To become a shareholder in a company, one needs to have the consent of the Board of Directors, and a resolution has been passed. The stocks in a private company. Private companies have more control over who can be a shareholder. The shareholders' agreement outlines their rights and obligations. Majority shareholders. Anyone can become a shareholder by buying stock in that company. In many countries, corporations may also offer employee stock options as a benefit for workers. Shareholders are often individuals or groups who engage in strategic decision-making and may be independent of a corporation. The majority shareholders control. Shareholders are also called stockholders, and when they invest in a company to obtain an equity of the company, they become the owners of that corporation. If any natural person, or any individual or legal entity, invests in the company shares, it is eligible to become a shareholder in a company. To become a. Becoming a registered shareholder in US-listed companies through Computershare Computershare acts as transfer agent/registrar to a range of US companies. For.

A principal shareholder is a person or entity that owns 10% or more of a company's voting shares. The company can be private or publicly traded, meaning the. Basically, if you are a shareholder, it means you own stock in a corporation. Owning corporate stocks gives you certain rights, including the right to attend. How a Shareholder Register Works Holders of registered shares of a company must be recorded in the shareholder register. The register is organized into share. Learn more about our Direct Investment Program, request company literature or sign up for for e-delivery of shareholder materials. be mailed to shareholders. Shareholders can also be known as members, and can become a shareholder by agreeing to take the minimum of one share in the company. The shareholders are the. When a company is created, the founders of the company must determine who owns the company. Often the founders also become the first shareholders of the. You can issue shares to a person or to another company (a corporate shareholder). Most companies have people as shareholders in a company, but issuing shares to. However, most shareholders acquire shares in the secondary market and provided no capital directly to the corporation. Shareholders may be granted special. However, most shareholders acquire shares in the secondary market and provided no capital directly to the corporation. Shareholders may be granted special. By becoming a shareholder, you will receive an annual dividend payment if the company offers one. You can also subscribe to receive all the Group's. When a company is created, the founders of the company must determine who owns the company. Often the founders also become the first shareholders of the. Rights and responsibilities of shareholders · aren't responsible for, and don't participate in, the day-to-day management of the company (unless you have. To be a shareholder, you must take a minimum of one share in a company. The number and value of shares held by each member represents how much of the business. It's become fashionable to blame the pursuit of shareholder value for the ills besetting corporate America: managers and investors obsessed with next. A company limited by shares must have at least one shareholder, who can be a director. If you're the only shareholder, you'll own % of the company. To be a shareholder, you must take a minimum of one share in a company. The number and value of shares held by each member represents how much of the business. In order to become an S corporation, the corporation must submit Form , Election by a Small Business Corporation signed by all the shareholders. See the. Shareholders who hold 34% of the Company's share capital. A record for a company listed on the CAC 40! Shareholder's composition. Text version. public. Bearer shareholders are only convened if they hold more than shares. The notice of meeting and voting material is available to everyone on the company. Consider all individuals who own shares in the company. Whether it be an employee whose job is on the line or an external party that relies on the financial.

What Is Port Folio

A stock market portfolio is an investors collection of stocks, funds, and other market-traded securities. In general, investment portfolios often include some. Key takeaways · A portfolio solution allows you to invest in a carefully chosen, well-diversified mix of mutual funds and/or exchange traded funds (ETFs). · The. A portfolio's meaning can be defined as a collection of financial assets and investment tools that are held by an individual, a financial institution or an. Portfolio Management. Portfolio management ensures that an organization can leverage its project selection and execution success. It refers to the centralized. A portfolio is a compilation of academic and professional materials that exemplifies your beliefs, skills, qualifications, education, training, and experiences. Portfolio Visualizer provides online portfolio analysis tools for backtesting, Monte Carlo simulation, tactical asset allocation and optimization. A portfolio is a collection of projects and/or programmes used to structure and manage investments at an organisational or functional level to optimise. In finance a portfolio is a group of investment products held by a private person, hedge fund, corporation, or financial institution. A portfolio in project management refers to a grouping of projects, and programs. It can also include other project-related activities and responsibilities. The. A stock market portfolio is an investors collection of stocks, funds, and other market-traded securities. In general, investment portfolios often include some. Key takeaways · A portfolio solution allows you to invest in a carefully chosen, well-diversified mix of mutual funds and/or exchange traded funds (ETFs). · The. A portfolio's meaning can be defined as a collection of financial assets and investment tools that are held by an individual, a financial institution or an. Portfolio Management. Portfolio management ensures that an organization can leverage its project selection and execution success. It refers to the centralized. A portfolio is a compilation of academic and professional materials that exemplifies your beliefs, skills, qualifications, education, training, and experiences. Portfolio Visualizer provides online portfolio analysis tools for backtesting, Monte Carlo simulation, tactical asset allocation and optimization. A portfolio is a collection of projects and/or programmes used to structure and manage investments at an organisational or functional level to optimise. In finance a portfolio is a group of investment products held by a private person, hedge fund, corporation, or financial institution. A portfolio in project management refers to a grouping of projects, and programs. It can also include other project-related activities and responsibilities. The.

What is a financial portfolio, what is needed to create one and what are its benefits and limitations? Read our definition to find out. In this article, we will explain the main concepts associated with an investment portfolio and review the most important valuation procedures. Each of these plays a unique role in your portfolio, providing the potential for growth, income, relative stability, or inflation protection. 1. Identify your investing goals. When it comes to creating an investment portfolio, it all starts with you and your aspirations. Portfolio management involves selecting and overseeing a group of investments that meet a client's long-term financial objectives and risk tolerance. A financial portfolio is a collection of investments and holdings like stocks, bonds, mutual funds, commodities, crypto, cash, and cash equivalents. A portfolio is a group of all the financial assets which an investor owns. Investors create their portfolios after analyzing their risk and return. PORTFOLIO meaning: 1. a large, thin case used for carrying drawings, documents, etc. 2. a collection of drawings. Learn more. We're going to fill you in on everything you need to know about portfolio value, including what it means, why you should be tracking it, and how to monitor. What is portfolio investment? ➢Definitions. ➢Presentation. ➢Relationship with other functional categories. ▫ Recording in BOP/IIP. ➢Valuation. ➢Accrued. portfolio A portfolio is a set of pictures by someone, photographs of their work, or examples of their writing, which they use when entering competitions or. What is Portfolio? The portfolio definition may vary depending on the investment goals, risk tolerance, and financial situation of a person. A portfolio. An investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash and cash equivalents. A portfolio can help you diversify your assets and spread your risk across stocks, bonds, and other types of investments. A portfolio is a systematic collection of student work that represents student activities, accomplishments, and achievements over a specific period of time. In finance, a portfolio is a collection of investments. Definition edit Description edit See also edit References edit Bibliography edit. Diversifying your portfolio may help you minimize risk and maximize your returns, bringing you one step closer to your financial goals. A portfolio company is a company (public or private) that a venture capital firm, buyout firm, or holding company owns equity. In other. It is one way to balance risk and reward in your investment portfolio by diversifying your assets. Diversification is the practice of spreading your investments. It is one way to balance risk and reward in your investment portfolio by diversifying your assets. Diversification is the practice of spreading your investments.

Can You Pay Off Collections

Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the. Make all payments to the IRS. The PCA will never ask you to pay them directly or through prepaid debit, iTunes or gift cards. The private collection agency can. The collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. Pay off the debt. Some collectors will. This repayment will remain as a transaction on your credit report for several years. This type of debt repayment could negatively affect your credit score. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. If you pay a debt collection account off, it will still remain on your credit report for seven years. The balance will show as $0 and the status would be listed. How does paying off a collection account affect your credit report? · You can avoid a debt collection lawsuit for unpaid medical or credit card bills. · You can. In some cases, they're paid by your original creditor to help collect the money you owe. Or they may purchase your past-due account from your creditor before. You are past-due, or delinquent, on your bills and your card issuer's collections representative calls you to pay your overdue balance. After about six. Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the. Make all payments to the IRS. The PCA will never ask you to pay them directly or through prepaid debit, iTunes or gift cards. The private collection agency can. The collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. Pay off the debt. Some collectors will. This repayment will remain as a transaction on your credit report for several years. This type of debt repayment could negatively affect your credit score. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. If you pay a debt collection account off, it will still remain on your credit report for seven years. The balance will show as $0 and the status would be listed. How does paying off a collection account affect your credit report? · You can avoid a debt collection lawsuit for unpaid medical or credit card bills. · You can. In some cases, they're paid by your original creditor to help collect the money you owe. Or they may purchase your past-due account from your creditor before. You are past-due, or delinquent, on your bills and your card issuer's collections representative calls you to pay your overdue balance. After about six.

Debt Collection From Divorced Parents - R You asked if a creditor can seek a joint debt from a person when that debt was assigned to an ex-spouse. However, do not ignore your other unsecured debts. Make every effort to pay them off as soon as possible. • Do not let a debt collector persuade you to borrow. With exceptions, your lender may require you to pay off any collections and charge-offs on your credit report. Even if your DTI is within a healthy range. Once the account goes to collections, you'll likely get aggressive phone calls and letters. At some point, you might even be sued. If the court doesn't rule in. Then, the safest way to pay off debt in collections online is by using your bank's online bill pay service. It's more secure than giving collectors your. Affirm provides notices of late payments and the potential for charge-off before the charge-off occurs, and will also notify you when your loan is charged off. If it purchases the debt, the collection agency keeps the full amount. After the creditor assigns your debt to a debt collector or the agency buys the debt, the. If you have past due debt that's been sent to collections, you may still be able to negotiate repayment directly with your lender. · Debt collectors are third-. Depending on the type of collection account you owe, attempting to negotiate a pay for delete settlement might not be necessary. Paid off medical debts, for. Creditors don't want to bring in a debt collection agency. But if it looks like you won't pay, they will. The creditor will sell your debt to a collection. The most secure way to pay is by certified mail with a check. Mail it at the post office and pay a little extra for a “return receipt.” The receipt will either. Paying off collection accounts you legitimately owe can help your credit in the long run. It will reduce your overall debt, improve your debt-to. You should pay the collection agency directly. Payment to the City department will not clear your account faster, as your account has already been transferred. Make all payments to the IRS. The PCA will never ask you to pay them directly or through prepaid debit, iTunes or gift cards. The private collection agency can. Remember, it is to the creditor's advantage to avoid bringing in a debt collection agency. However, if it begins to look as if you will not be able to pay the. On November 30, , the Debt Collection Rule became effective. The rule clarifies how debt collectors can communicate with you, including what information. Paying off debt in full is best for your credit score and avoiding lawsuits. If you can't pay in full, settling the debt is still a viable option. The mark is likely to stay on your credit report for up to seven years even if you pay off your debt with the collection agency. It's also possible that paying. Important things to know · If you owe a debt collection company, they are likely to accept a smaller amount · You may be able to offer to pay part of the amount. Don't Make Decisions Based on Debt Collection Harassment. A debt collector's job is to convince you to pay its debts first. Instead, make your own decision.

What Index Funds Should I Buy

This means they aim to maximize returns over the long run by not buying and selling securities very often. In contrast, an actively managed fund often seeks to. No,Never invest in Multiple Index fund. · The reason is all the index fund replicate the index performance so all the index fund deliver the. Index funds are considered less expensive and less risky for investors. Here are the nine best index funds to add to your portfolio for steady, low-cost. Should financial advisors be banned from collecting commissions on mutual funds? Should You Buy Stocks For Your Kids? If you're a parent, how can you set. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. invest in an index fund or an actively managed fund. Active or index You should consider the investment objectives, risks, charges and expenses carefully. This often results in fewer taxable capital gains distributions from the fund, which could reduce your tax bill. Lower costs. All index funds have professional. Index mutual funds and ETFs tend to have low turnover—meaning they buy and sell securities less frequently—potentially generating fewer capital gains. Over time. Best S&P index funds · Fidelity Index Fund (FXAIX). · Vanguard Index Fund Admiral Shares (VFIAX). · Schwab S&P Index Fund (SWPPX). · State Street. This means they aim to maximize returns over the long run by not buying and selling securities very often. In contrast, an actively managed fund often seeks to. No,Never invest in Multiple Index fund. · The reason is all the index fund replicate the index performance so all the index fund deliver the. Index funds are considered less expensive and less risky for investors. Here are the nine best index funds to add to your portfolio for steady, low-cost. Should financial advisors be banned from collecting commissions on mutual funds? Should You Buy Stocks For Your Kids? If you're a parent, how can you set. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. invest in an index fund or an actively managed fund. Active or index You should consider the investment objectives, risks, charges and expenses carefully. This often results in fewer taxable capital gains distributions from the fund, which could reduce your tax bill. Lower costs. All index funds have professional. Index mutual funds and ETFs tend to have low turnover—meaning they buy and sell securities less frequently—potentially generating fewer capital gains. Over time. Best S&P index funds · Fidelity Index Fund (FXAIX). · Vanguard Index Fund Admiral Shares (VFIAX). · Schwab S&P Index Fund (SWPPX). · State Street.

An index fund is a financial instrument that provides exceptional diversity at low cost. It is traded like a stock, except that when you buy a stock you. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. Index mutual funds offer a cost-effective, potentially tax-efficient way to diversify your portfolio. On this page: What is an index mutual fund? The decision to invest in index funds—and how to manage them as part of a wider portfolio—should be based on your financial situation, goals, and risk tolerance. The best index funds to buy are broad based, passively managed, low expense ratio index funds. If your account is a Fidelity, Fidelity's S&P When an investor invests in an index fund, he buys a blend of investments that mimics the makeup of a market index. The investors can buy all these assets in. could include actively managed funds, index funds, and other investments. An order to buy or sell an ETF at the best price currently available. In most. You cannot invest directly in an index. Performance - QUARTERLY. 06/30 INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider. This site and all the information contained herein is general and/or educational in nature. Individuals should consult an investment advisor before making any. Many investment strategists believe index funds should be a core component of a retirement portfolio. index funds to customize how you want to invest. Index mutual funds offer a cost-effective, potentially tax-efficient way to diversify your portfolio. On this page: What is an index mutual fund? Index funds purchase all the stocks in the same proportion as in a particular index. Check out the list of top performing index mutual funds and invest. There are two ways to buy index funds inside a brokerage account: by the share or the dollar. Traditionally, only mutual funds let you place dollar-based trades. An index fund is an investment vehicle that tracks an index. An index tracks how stock a stock market, or other assets, perform that meet certain criteria. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. Index funds are baskets of stocks that follow a specific market index. For example, popular index funds give you exposure to the same stocks as the S&P , Dow. Get information about what index funds are, index fund verticals, and funds you can invest in on Public Certain requirements must be met in order to trade. An index fund is a financial instrument that provides exceptional diversity at low cost. It is traded like a stock, except that when you buy a stock you. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the.

Cheap But Good Car Insurance Quotes

Compare car insurance quotes and save $* on average. tsg-upravdom.ru Auto Insurance Get Quotes Now We do not operate in your province. We all need auto insurance, and the best place to start is with a free car insurance quote. Whether you're looking for affordable car insurance rates. What are the benefits of low cost car insurance? · Are there risks to getting cheap car insurance? · What makes GEICO car insurance affordable? · What type of car. USAA, GEICO, and State Farm offer affordable. car insurance rates for new drivers., but it still pays to shop around to find the best rate for you. Cheapest. Geico, USAA and State Farm are often among the cheapest. Last updated: Aug 21, 10 min read. Compare quotes in less than 5 minutes. auto Insurance. Erie tops our list of the cheapest auto insurance companies with rates starting from as low as $22 per month. Find cheap car insurance here and save on your. The cheapest car insurance company in this situation is USAA, which still offers eligible drivers affordable rates after an accident ($ per month). However. Discounts & savings Allstate offers discounts on auto insurance policies, including lower premiums for safe drivers, low mileage drivers and bundled services. Mercury offers affordable car insurance without sacrificing quality support and service. Talk with an agent today to help you find cheap car insurance. Compare car insurance quotes and save $* on average. tsg-upravdom.ru Auto Insurance Get Quotes Now We do not operate in your province. We all need auto insurance, and the best place to start is with a free car insurance quote. Whether you're looking for affordable car insurance rates. What are the benefits of low cost car insurance? · Are there risks to getting cheap car insurance? · What makes GEICO car insurance affordable? · What type of car. USAA, GEICO, and State Farm offer affordable. car insurance rates for new drivers., but it still pays to shop around to find the best rate for you. Cheapest. Geico, USAA and State Farm are often among the cheapest. Last updated: Aug 21, 10 min read. Compare quotes in less than 5 minutes. auto Insurance. Erie tops our list of the cheapest auto insurance companies with rates starting from as low as $22 per month. Find cheap car insurance here and save on your. The cheapest car insurance company in this situation is USAA, which still offers eligible drivers affordable rates after an accident ($ per month). However. Discounts & savings Allstate offers discounts on auto insurance policies, including lower premiums for safe drivers, low mileage drivers and bundled services. Mercury offers affordable car insurance without sacrificing quality support and service. Talk with an agent today to help you find cheap car insurance.

Southern Harvest is here to help you get affordable car insurance in Georgia. Don't look any longer for cheap car insurance in Georgia. You've come to the right. Are you looking for cheap car insurance in Texas? Freeway Insurance walks you through how to find affordable car insurance in TX. USAA, GEICO, and State Farm offer affordable. car insurance rates for new drivers., but it still pays to shop around to find the best rate for you. Cheapest. Get Multiple Auto Insurance Quotes. Take the time to contact multiple providers for affordable auto insurance quotes. If you are over-paying, you'll never know. The Cheapest Car Insurance Companies. We ranked the best cheap car insurance companies to help you find an insurer that best suits your budget. Keep in mind. Comparing car insurance quotes is the best way to find affordable coverage for your needs. Here's what you need to know about finding cheap car insurance in. We all need auto insurance, and the best place to start is with a free car insurance quote. Whether you're looking for affordable car insurance rates. Find the cheapest car insurance quotes in Ottawa instantly. Compare rates from Canada's top auto insurance providers and save up to 25%. Get a free quote. best liability-only car insurance with the cheapest average rates Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes. Other ways to make your car insurance cheaper · Bundle and Save. Save up to 10% when you bundle auto and property policies. · Multi-Vehicle Discount. You'll save. The secret to finding cheap car insurance in these provinces is to compare auto insurance rates from as many insurers as possible. Some websites compare rates. Policy Discounts. Getting discounts can lower your auto insurance rates and make them more affordable. You can typically get discounts by bundling home and auto. See which company offers the best cheap car insurance. Compare coverage options, find affordable auto insurance and save on your next policy. Compare Home. best way to get cheap car insurance is to compare quotes from several inexpensive Individual rates will be different. Video: Cheapest Car Insurance Companies. cheapest, but best quality car insurance. Ask for the most affordable good position to start comparing cheap car insurance quotes from different insurance. We make it easy to get a cheap car insurance quote without sacrificing on quality coverage Discover which makes and models tend to get the cheapest rates. Finding cheap car insurance is easy with tsg-upravdom.ru Get the cheapest auto insurance quotes that do not compromise on coverage. Get your free quote in minutes. Finding cheap car insurance is easy with tsg-upravdom.ru Get the cheapest auto insurance quotes that do not compromise on coverage. Get your free quote in minutes. Cheapest recent rates. Drivers using Insurify have found quotes as cheap as $34/mo for liability only and $ State Farm offers many coverage options, from auto insurance for teen drivers to rental cars and more. Switch and save an average of $